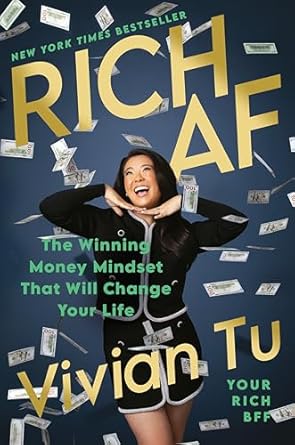

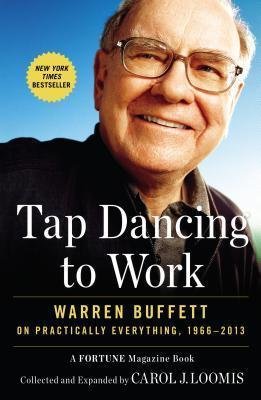

📖 Tap Dancing to Work

Author(s): Carol Loomis

Published: 2013

Category: Investing (click to see more books)

🔰 Learn How To Read More Books, Learn More, Improve Productivity

⏱ Quick Read

"Tap Dancing to Work: Warren Buffett on Practically Everything, 1966-2013" is a treasure trove of insights into one of the world's most successful investors, Warren Buffett. Curated by Carol Loomis, a veteran editor at Fortune magazine and Buffett's long-time friend, this book compiles nearly five decades of articles and essays that chronicle Buffett's rise from a little-known Omaha investor to a titan of global finance. The book offers readers an intimate look into Buffett’s investment strategies, his management philosophy at Berkshire Hathaway, and his unique perspective on philanthropy and life. Through these articles, we see the evolution of Buffett’s thinking, his deep commitment to value investing, and his unyielding belief in the long-term potential of the American economy. Loomis's commentary adds depth, explaining the significance of each piece and providing context to Buffett's predictions and actions. This collection not only serves as a historical record but also as a masterclass in business acumen, with lessons that are as relevant today as they were decades ago.

"The key to successful investing is to remember that stocks are not just ticker symbols or little blips on a chart. Behind every stock is a company. Find out what it’s doing."

– Carol Loomis

🔑 Key Takeaways

- Invest in businesses, not stocks; focus on long-term value over short-term market fluctuations.

- Patience is crucial; successful investing requires time and the discipline to wait for the right opportunities.

- Value investing is about buying quality businesses at prices below their intrinsic worth.

- Consistent, incremental growth trumps quick gains; compounding is the true wealth builder.

- Trust in American enterprise; the U.S. economy's resilience provides a strong foundation for long-term investments.

- Avoid debt and leverage; financial safety comes from conservative and prudent financial management.

- Corporate management quality is key; invest in companies with strong leadership and sound business practices.

- Learn from mistakes; even the best investors make errors, but they treat them as lessons.

- Simplicity over complexity; successful investment strategies are straightforward and understandable.

- Philanthropy is a vital responsibility; giving back is as important as accumulating wealth.

📝 Actionable Lessons

- Prioritize long-term financial goals by consistently investing in quality businesses with strong fundamentals.

- Develop patience and discipline in all financial decisions, avoiding impulsive actions based on short-term market movements.

- Focus on continuous self-improvement and learning to enhance decision-making and judgment in personal and professional life.

- Simplify your financial strategy by avoiding unnecessary complexity and sticking to proven, straightforward methods.

- Embrace the responsibility of giving back by incorporating philanthropy and community service into your life.

✒️ Author Snapshot

Carol J. Loomis, a senior editor-at-large at Fortune magazine, has been a prominent financial journalist since 1954. Known for her close friendship with Warren Buffett, she edited his annual shareholder letters for decades. "Tap Dancing to Work" is her first book, showcasing Buffett's wisdom over nearly five decades.

📡 Latest posts from category

- The Psychology Of Money (Master the Psychology of Money and Build Lasting Wealth Through Simple Habits)

- The Latte Effect (How to Build Wealth Starting with Your Morning Coffee)

- The Automatic Millionaire (The Secret to Becoming a Millionaire on Autopilot)

- The Next Millionaire Next Door (How Ordinary People Achieve Extraordinary Wealth)

- The Millionaire Next Door (The Secret Habits of Millionaires You’ve Never Heard Of)

📧 Sign up for our Knowledge Unlocked newsletter and be the first to read our new book summaries.